She Thought Being His Wife Was Enough. It Wasn’t. | Family First Estate Planning

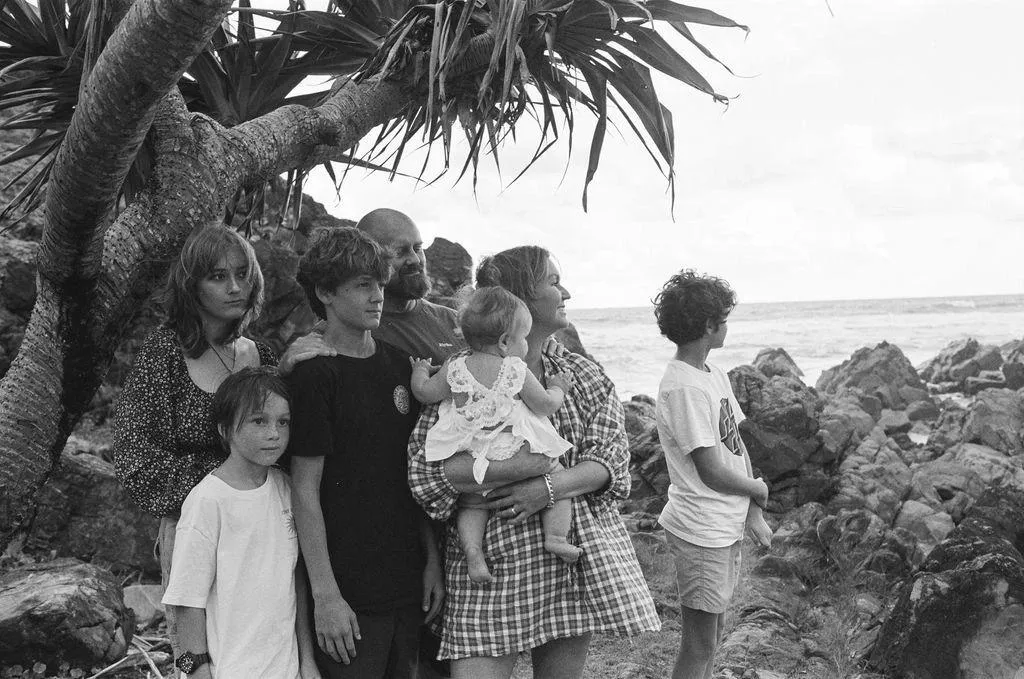

Lucy and Dan are both in their early 40s. They’ve got two little ones — 4 and 7.

Dan runs a successful building company. Lucy’s a stay-at-home mum.

Then one morning, everything changes.

Dan has a fall on-site. A serious traumatic brain injury. He’s in hospital, and the prognosis isn’t good. He’ll need long-term care — and he won’t be returning to work anytime soon.

Here’s what Lucy didn’t expect

Even though their family home was in both their names, Lucy couldn’t refinance or restructure anything to access equity. Dan didn’t have an Enduring Power of Attorney in place, so she had to apply to NCAT (the NSW Civil & Administrative Tribunal) just for permission to make basic financial decisions.

The process took weeks and cost thousands in legal and tribunal fees — all at the worst possible time.

It didn’t stop there.

Dan was the sole director and shareholder of his company. Without a Corporate Power of Attorney, no one had legal authority to operate the business. Invoices couldn’t be paid, jobs stalled, subcontractors walked, and clients began to panic.

The business income that supported Lucy and the kids disappeared almost overnight. The company started to unravel, and there was nothing Lucy could legally do to stop it quickly.

All while she was caring for two young children and trying to make impossible decisions about Dan’s long-term care.

The hardest part

All of this stress, delay and cost could have been avoided — with just two documents that could have been prepared for under $1,200:

An Enduring Power of Attorney (for personal and financial decisions)

A Corporate Power of Attorney (to authorise someone to act for the company)

These aren’t just forms. They’re lifelines that keep families and businesses functioning if the unexpected happens.

Plan early. Plan like you love them.

Estate planning isn’t just about ticking boxes. It’s about protecting the people who would be left picking up the pieces if something goes wrong.

Without those powers in place, even a devoted spouse can be left completely powerless.

Plan early. Plan like you love them.

(Lucy and Dan’s story is an anonymised case study designed to help families understand how not having essential documents can impact everything when life takes an unexpected turn.)

Next steps

If you’d like to make sure your family would be protected if something unexpected happened, here’s how to take the next step:

Download our Pricing and Packages guide

– see exactly what’s included and how it works.

Book a free 15-minute Legal Clarity Call

– ask questions and get personalised guidance.

– make sure your family is protected if something goes wrong.

Disclaimer

This article provides general information only and is not legal advice. You should seek personalised advice from a qualified estate planning professional before making decisions about your Will or Powers of Attorney.